kentucky inheritance tax calculator

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. For any amount over 12500 but not over 25000 then the tax rate is 6 plus 625.

Property Tax How To Calculate Local Considerations

Class B beneficiaries pay a tax rate that can vary from 4 to 16.

. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money. Class A beneficiaries pay no taxes on their inheritances.

Anna is licensed to practice law in Kentucky and West Virginia and enjoys. The last thing a testator wishes to leave his loved ones is an unexpected tax bill. This applies to each person in a marriage or civil partnership.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. As you can imagine there are nuances to this tax beyond those which can be explained here. The good news is that there are lots of ways to cut down your bill which.

Inheritance taxes on the other hand are concerned about beneficiaries. The inheritance tax in this example is 76670. In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500.

It may be possible to minimize the inheritance tax with an alternate estate planning device which can be explored by consulting a qualified estate planning attorney. The state of Kentucky considers a wide range of items taxable including. Kentucky Income Tax Calculator 2021.

Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. The siblings who inherit will then pay a 11-16 tax rate. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

State inheritance tax rates range from 1 up to 16. Ad Download Or Email Form 92A205 More Fillable Forms Register and Subscribe Now. Kentucky does have an inheritance tax.

For Kentucky inheritance tax purposes in the surviving spouses estate. Beneficiaries are responsible for paying the inheritance tax. Like most other states that impose this tax the Kentucky inheritance tax rates are straightforward and easy to understand.

This affidavit is being. Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return Form 706 is not required to be filed because the gross estate is less than the required amount set out in Section 2010c of the Internal Revenue Code. The tax to Class C beneficiaries for gifts of that size is calculated at 28670 plus 16 of the amount over 200000.

Kentucky Inheritance and Gift Tax. Most states do not impose an inheritance tax or an estate tax. Its important to calculate and pay these taxes promptly.

As a result it will not be assessed against many folks. The inheritance tax is not the same as the estate tax. 110 effective July 15 2010.

The inheritance tax is not the same as the estate tax. While they do assess an income tax and of course real estate taxes there is no estate tax. Updated for the 2021-22 tax year.

By way of example if the deceased person was a resident of Kentucky rather than a nonresident who owned property in Kentucky a. The Kentucky inheritance tax is a tax imposed on certain beneficiaries who inherit property or money from a Kentucky estate. You may qualify to pay Inheritance Tax at a reduced rate of 36 if you leave at least 10 of your net estate to charity.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. An inheritance tax is usually paid by a person inheriting an estate. If you have additional questions about Kentuckys inheritance tax please do.

The first 50000 is taxed at 10. Estimate the value of your estate and how much inheritance tax may be due when you die. Call an experienced estate planning attorney like Anna M.

So a husband and wife could give 6000 to their family each year or 12000 in any year when they did not make a. By contrast a nephew in Iowa has a different tax rate. The major difference between estate tax and inheritance tax is who pays the tax.

Individuals are entitled to give away 3000 in total in any tax year free from IHT. Only about 12 of 1 of people will pay an estate tax. If the exemption is not used in one year it can be carried over to the next.

The tax is only levied against estates for individuals who have net assets that exceed 117 million for 2021. -- Amended 1986 Ky. 455 effective June 20 2005.

Inheritance Tax reduced rate calculator. For a detailed chart see the inheritance tax table in the Kentucky Department of Revenues Inheritance Tax Guide. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

States levy inheritance tax on money and assets after theyre already passed on to a persons heirs. July 15 2010 History. Tenant and the tax upon such interest has not been fixed and determined the value.

The higher the amount the higher the tax rate. Use this calculator to work out. The value of all bank and investment accounts.

The size of the inheritance and the beneficiary. The highest property tax rate in the state is in Campbell County at 118 whereas the lowest property tax rate in Kentucky is 056 in Carter County. Surviving spouses are always exempt.

The kentucky inheritance tax is a tax on a beneficiarys right to receive property from a deceased person. Up to 25 cash back The exact tax rate depends on the amount inherited. The beneficiary only has to file a tax return if his or her inheritance is considered taxable.

There are a total of 120 counties in the state of Kentucky and each county houses a different tax rate. Thanks to something called portability this estate tax exemption limit can be increased in many situations. -- Amended 2005 Ky.

Inheritances in Kentucky are taxed based on the recipients relationship to the deceased as well as the value of the property. Some states like Tennessee impose neither an inheritance or estate tax though. Your household income location filing status and number of personal exemptions.

In fact when the inheritance tax. Kentuckys revised statutes krs 391035 outlines court procedures for the handling of. Price from Jenkins Fenstermaker PLLC toll-free at 866 617-4736 or use Annas online contact form to set up a consultation.

2021 Major Tax Breaks For Taxpayers Over Age 65

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

What Is The Difference Between An Inheritance Tax And An Estate Tax

Kentucky Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

Tax Optimization Tax Planning Bogart Wealth

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

What Are Estate Taxes Experian

Delinquent Property Tax Department Of Revenue

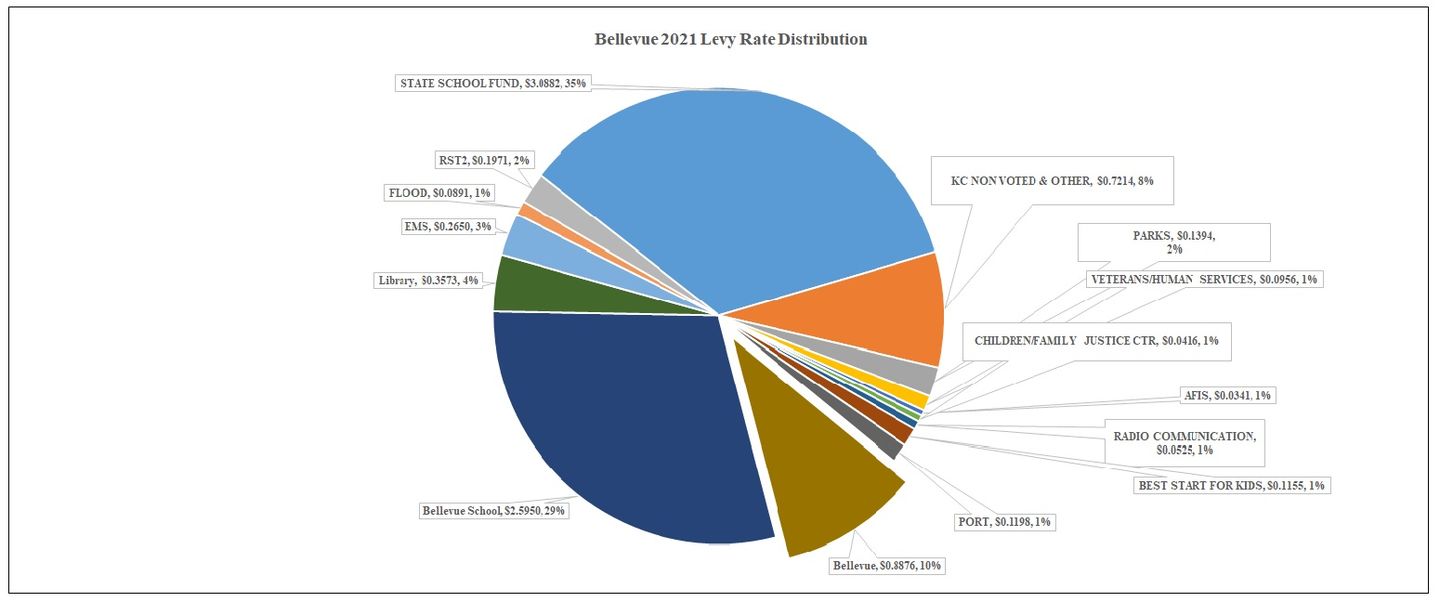

Bellevue Property Taxes City Of Bellevue

Michigan Inheritance Tax Explained Rochester Law Center

Military Exemptions Department Of Revenue

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

How Much Tax Will I Pay If I Flip A House New Silver

Inheritance Tax Which States Who Pays 2021 22 Personal Capital

Taxes On Your Inheritance In California Albertson Davidson Llp

Eight Things You Need To Know About The Death Tax Before You Die